Mortgage Foreclosure

If you own a home and fall behind your mortgage payments, the lender may start the foreclosure process. The lender has to provide you with proper pre-foreclosure notices. There are two different Pennsylvania laws that require very specific pre-foreclosure notices (Act 6 and Act 91), depending on the type of mortgage you have. Usually, the bank uses one notice to give the homeowner notice under both Acts.

After the 33 days has passed from the mailing of the notice, the lender can file with your County Court of Common Pleas a “Complaint in Mortgage Foreclosure”. This is the legal document relating to foreclosure. The sheriff will personally deliver this complaint to your residence and serve it on you or one of your family members. You will have 20 days from the date of the personal delivery to respond to the foreclosure in court. If you fail to do that within the 20 day period, then your mortgage company must send you a “10 day warning” letter, indicating that unless you respond within 10 days, then it will file a final judgment with the Court

If you are more than sixty days behind in payments on your mortgage or have been served with a foreclosure notice, we may be able to help. Even if you have not been able to make your monthly payments, there are options that may allow you to save your home. Some of the options may include:

- making sure the mortgage company properly evaluates you for forbearance or loan modification

- having a non-profit housing counselor review your eligibility for government programs

- having a legal professional review emergency mortgage assistance denials

- getting an attorney to help defend against the denial of assistance or the foreclosure lawsuit, or

- considering bankruptcy options in an effort to save your home.

If you have decided you no longer want to keep your home, there are legal consequences you should consider such as loss of equity, requirements to keep up the property until the deed is transferred, and whether you may still owe money after a foreclosure.

We may also offer assistance if you are current on your mortgage but are having some dispute with your mortgage company about issues on your billing statement.

For additional resources click here:

Pennsylvania Homeowner Assistance Fund (PAHAF)

Pennsylvania Homeowner Assistance Fund (PAHAF) FAQs

-

What Is PAHAF?

PAHAF stands for the Pennsylvania Homeowner Assistance Fund. This is a federally funded program to help Pennsylvania homeowners who have been unable to pay their mortgage, taxes, and/or some other household debts because of COVID-19.

-

How Do I Apply for Help?

You can apply for help in two different ways. You can apply online at https://pahaf.org or by telephone at 1-888-987-2423.

-

Am I Eligible for Help?

You may be eligible for help if the following sounds like your situation:

- I have experienced a financial hardship after January 21, 2020, OR I experienced a financial hardship before January 21, 2020, but that hardship continued after January 21, 2020.

- My income falls into one of these two categories:

- My income is equal to or less than 150% of the area median income, OR

- My income is 100% of the median income for the United States ($79,900)

- You can find the area median incomes here: https://www.huduser.gov/portal/datasets/il/il2021/select_Geography_haf.odn

- I currently live in the home I am trying to save, and that home is located within Pennsylvania.

-

If I Qualify, What Kind of Help Could I Receive?

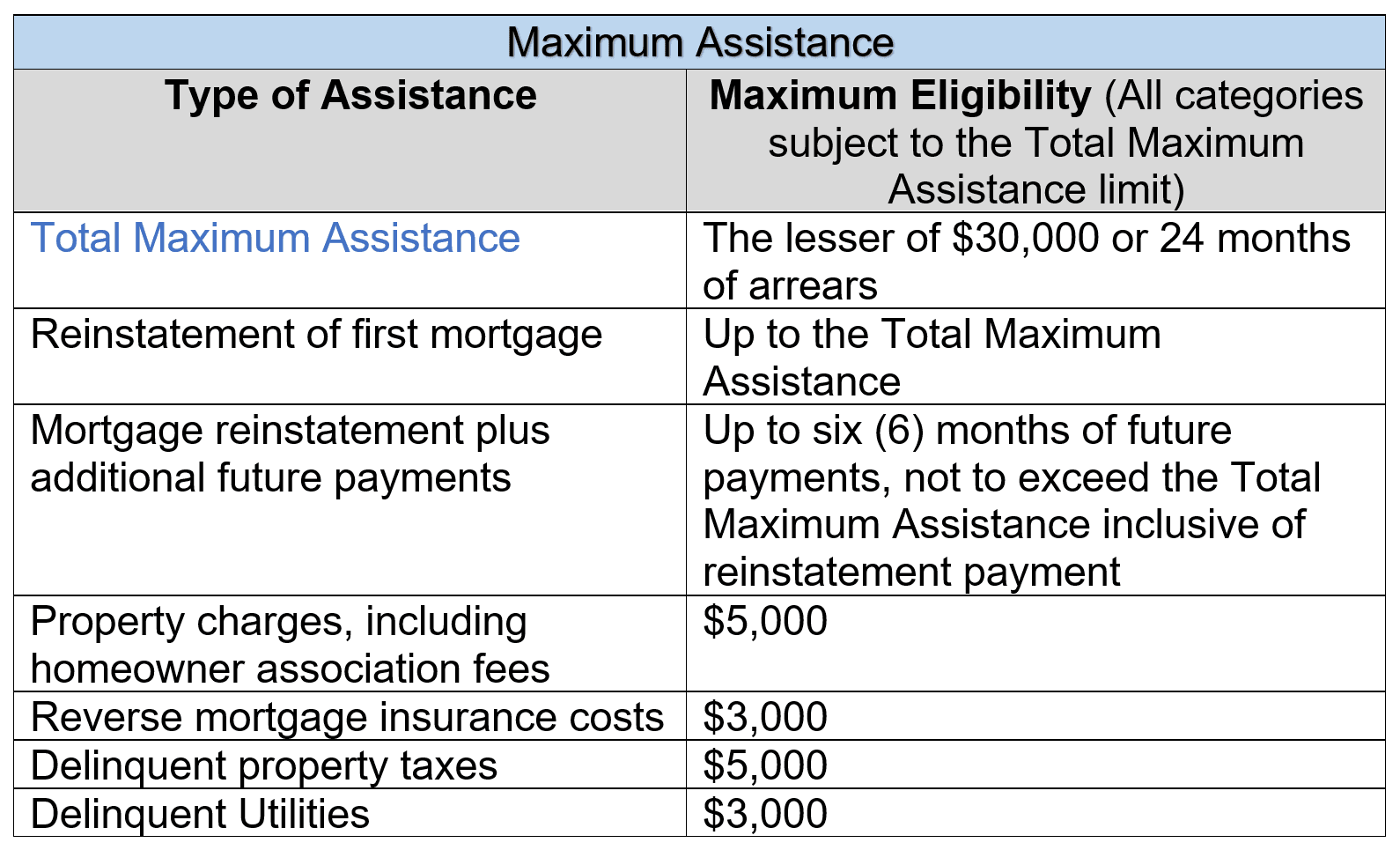

Homeowners may receive money to pay the delinquency and reinstate the mortgage, as well as future payments towards the mortgage. You also may be able to get relief with delinquent taxes if the delinquency places the homeowner at risk for mortgage foreclosure or displacement from the home. Utility assistance may be available for homeowners with arrears as they apply for other assistance or as an application for utility assistance only.

-

Can I Apply Directly For PAHAF?

Yes, you can apply directly to PAHAF for assistance. You can also get help from NPLS if you live in our service area, so we can help you understand the program and help you with the application, if needed. You must promise to work with the organization that is helping you submit your application, or with PAHAF directly if you are applying by yourself. This means that you must gather certain documents when requested and regularly communicate any problems you have gathering information.

-

What if I Applied for Other Assistance?

You must report other assistance you have received, because you cannot get help from two different funds for the same months. For example, if you received energy assistance, you may not be able to get help with your utilities FOR THE SAME MONTHS under this program. You can apply for help for other months.

This does NOT mean medical assistance or financial assistance outside of those programs meant to pay for your mortgage. So, if you received medical assistance, supplemental nutrition assistance, and Social Security, you could apply for this assistance.

View the PAHAF Flyer

Other FAQs

-

Are there mortgage relief programs available in Pennsylvania?

Yes! Pennsylvania has a robust history of providing Homeowners Emergency Mortgage Assistance Program (HEMAP). You can apply by contacting the Pennsylvania Housing Finance Agency.

-

I received an Act 91 notice, now what?

When you get this notice, you must contact a Housing Counselor on the list provided and have a face-to-face meeting within 33 days of the date it was postmarked to apply for assistance. Pennsylvania has a loan program called Homeowner’s Emergency Mortgage Assistance Program (HEMAP) that can provide emergency assistance. This is very important; you have limited time to get your application to the Pennsylvania Housing Finance Agency (PHFA) and the housing counselors help you apply. If you submit your application, PHFA has sixty days to review the application and during that time, the lender cannot file foreclosure. More information about HEMAP is available at PHFA’s website, www.phfa.org.

If more than 33 days have passed, you should still apply for assistance, however you may be responsible for more of the lender's costs and fees and they might be able to continue with the foreclosure action.

-

What is HEMAP?

Pennsylvania has a loan program called Homeowner’s Emergency Mortgage Assistance Program (HEMAP) that is available if you have fallen behind on your mortgage through no fault of your own. HEMAP loans can cover back payments (arrears) as well as up to 24-36 months of future payments. These loans may be one time payments for the arrears or ongoing to help with future payments. In order to qualify, you must be able to show that you are likely able to restart your regular mortgage payments within 3 years. HEMAP loans do have to be repaid, but the monthly payment is based on your income and will not be less than $25.00 per month. If you sell the property before paying back the HEMAP loan, it will get paid from the sale.

More information about HEMAP is available at PHFA’s website, www.phfa.org.

-

I received an Act 91/Act 6 notice, but I did not contact a certified housing counselor within 30 days, can I still ask for help?

Yes! You may still be able to receive assistance. However, you may not be entitled to a pause in the proceeding, and you may be responsible for the lender’s attorney’s fees.

-

Do I have to leave my home on the day of the Sheriff Sale?

No. In Pennsylvania, the Sheriff’s Office has between 20 and 40 days (this means that the Sheriff cannot transfer the deed in less than 20 days, but must do so before 40 days) to transfer the deed to the new purchaser. The new purchaser must file an Ejectment Action in the Court of Common Pleas if anyone is still living in the home and does not leave voluntarily.

-

What should I do if I’m served an Ejectment Action?

If you are served an Ejectment Action, you should contact an attorney as soon as possible. You have 20 days to respond to the complaint. If you do not respond, you will get another notice giving you an additional 10 days to respond from the date it is mailed. If no response is filed, the court will enter a judgment for possession. The plaintiff will then be able to ask for an order to remove you from the home.

-

Can I appeal if I have a Judgment for Possession against me?

You have ten days to appeal a Writ for Possession. If you do not appeal within that timeframe, you typically cannot appeal. Appeals in these types of cases are very difficult to win. After those ten days have passed, you will receive a notice of the date and time by which you must vacate the home.

-

What is Cash for Keys?

If the lending bank has purchased the home at the sheriff’s sale, they may be willing to give Cash for Keys to assist you in moving to a new home. The sooner you request this and the sooner you vacate the home, the more money you can ask for. If approved, you must remove all of your belongings and leave the home clean. They will then do a walkthrough and if your home is in broom swept condition, they will issue you a check.

-

I know I missed monthly payments. Do I have any defenses to foreclosure?

Probably! You also may qualify for certain assistance programs either through your mortgage company or through the state. You should check with a certified housing counselor or an attorney.

-

Can I obtain a forbearance if my mortgage is not government-backed?

Yes. Many mortgage companies provide options for forbearance. You should contact your service directly to find out about your options. If you would like assistance, you could contact a non-profit housing counselor to discuss your options.

-

I was approved for a deed-in-lieu of foreclosure and a short sale. What are those?

A deed-in-lieu of foreclosure is when you sign over your home to the bank instead of them instituting a foreclosure action. A short sale is when the bank agrees to allow you to sell the home and they will accept less than the amount owed on the mortgage. This amount must be approved by the bank.